Contents

- Improve your Elliott Wave analysis: Gain insights and learn advanced techniques.

- Which one is the best Elliott Wave software?

- Asian-Pacific Financial Forecast Service

- Select Your Platform Here!

- Trading Service: Get Concise, Easy-to-Implement Advice

- Answering a common question: Is there Elliott Wave software or NEoWave software?

Click to read Glenn Neely’s thoughts about the likelihood of developing Elliott Wave software. Instead, Glenn Neely’s NEoWave Forecasting service presents a logical, scientific, objective approach to Wave analysis – a proven approach that results in more accurate forecasts. In addition, with conventional Elliott Wave Theory the analyst hopes the market will move up or down a certain number of Waves. What this means is that you don’t have to bother yourself so much with the actual wave counts themselves.

- Genetic – employs a natural selection approach to find an optimal combination without having to evaluate all possible combinations of the strategy settings.

- FiboCross Indicator and SwingCatcher Indicator are available exclusively to Ultimate edition users.

- The platform was established in 2015 April and since then the software has gone through numerous upgrades and new releases.

- This is why the best Elliott Wave software is one that can cover the charting and trading of Elliott Wave, as well as enable access to multiple markets such as forex, stocks, indices and commodities.

Chart linking is a powerful feature that enables you to apply an action to a set of charts . If you’d like a custom indicator created for you, our Support Team can put you touch with a recommended developer who can give you a quote. Highly customizable chart and trading preferences in an easy-to-use, intuitive interface. All Elliott Wave patterns and degrees of the Elliott Wave Theory are supported.

Improve your Elliott Wave analysis: Gain insights and learn advanced techniques.

Simple Price Alerts are included in all of the current MotiveWave editions. Practice your trading and test out new trading ideas in MotiveWave’s Replay Mode. Visit our User Forum to get coding tips and to discuss coding your study with other MotiveWave users.

One of the greatest examples is the appearance of the Elliott Wave in crypto trading. The following two images give you an idea of how charts are displayed. On the website you’ll find a detailed guide, video tutorials, and recorded webinars to help you get up to speed with the software. However, the platform is so well designed and so clearly structured that you don’t necessarily need them. Just go to the website, download the edition you want, and sign up for a free trial. Configurable Trade Panel – Modify the layout of the Trade Panel to rearrange existing sections and create your own sections, add widgets/controls and customizable order buttons within the Trade Panel.

It uses indicators such as Fibonacci, Gartley, Gann, and many others. The best thing about this software is that it can be a great option for traders of all different budgets. It also gives traders the opportunity to access different types of guides on trading markets, to further enhance their knowledge and understanding of Forex trading. It comes with an amazing 46 percent win rate and is capable of providing traders with 7 percent monthly returns, with just a 2 percent risk per trade. The software offers traders additional services, such as special video tutorials and analysis, which are used by traders to learn more about the market.

WaveBasis is a web trading platform that is primarily used for technical analysis and automated Elliott Wave trading. This proprietary web-based software provides access to exclusive tools that target wave analysts using EW patterns in day-to-day trading. WaveBasis runs an advanced pattern recognition engine that is automated to determine high probability and valid EW counts.

Which one is the best Elliott Wave software?

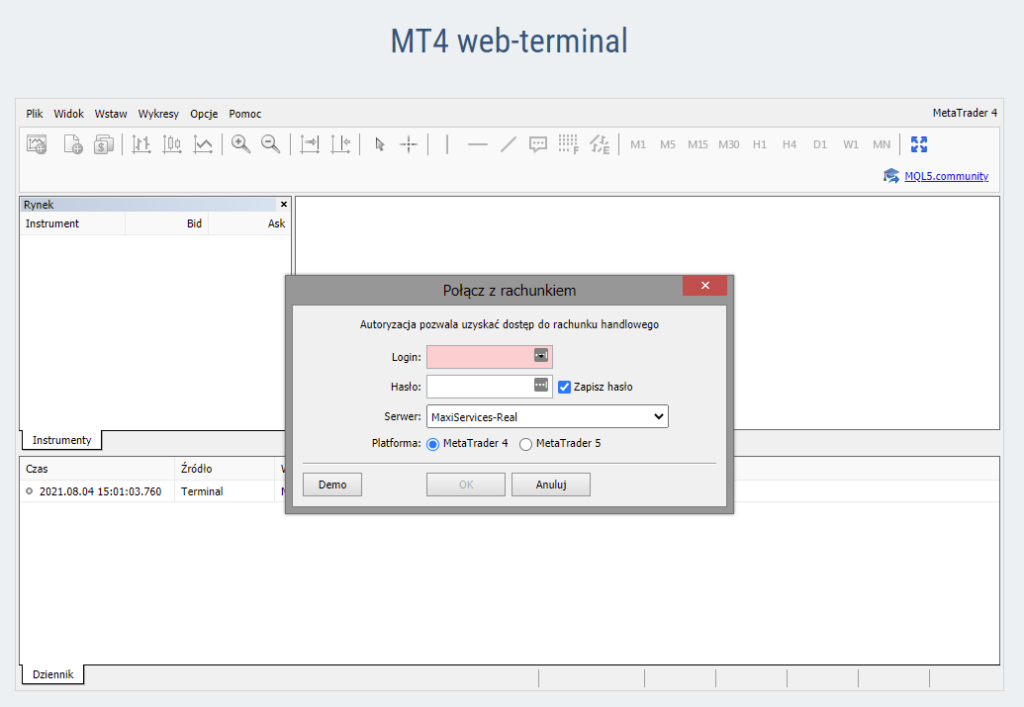

Some of the patterns described in Elliott Wave theory, such as corrective wave patterns are too complex to handle for a beginner trader. In most cases, you will meet the MetaTrader 4 and MetaTrader 5 platforms with EW strategy implementation, but sometimes the proprietary software options work the best. We will cover several Forex trading software for the Elliott Wave theory application that proved to be the best choices currently available on the market. Trading has large potential rewards, but also large potential risk. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in this site or videos.

As the broader trend is down, some sellers step into the market at the beginning of Wave B, in a weak move lower. As the broader trend is up, some buyers step into the market at the beginning of Wave B, in a weak rally higher. EW Components – Allows you to drag a pattern onto the chart and then ‘wire up’ the points where you want them. Elliott Wave labels are always automatically added for you, significantly cutting down your analysis time. An option chain panel enables you to see the available options organized by strike price for a given expiry date.

Our award-winning simplified wave trading system might a good place to start (a sponsored version is currently available for free🔥). For traders looking to do stock picking , the Scan Inspector offers a unique way to filter out those symbols . By scanning for criteria on multiple time frames you can scan for, say, a ‘wave 3 in a wave 3 in a wave 3′, or simply for an umarkets review uptrend in 3 consecutive time frames. Apply your own criteria for reward, risk and riskreward and you will have your own tailor-made trading setup scanner. The first indicator – Alligator is used for performing the trades during the trend moves and missing out on sideways markets. Hence, it’s one of the favorite indicators of Elliot Wave automated trading followers.

At this time, SWAT is the best Elliott Wave trading software available on the market. First of all, SWAT operates on a MetaTrader 4 system and is highly flexible and sustainable for various strategies and trading applications. It offers one of the most advanced Forex wave analysis interpretation and implementation into EW traders’ routines.

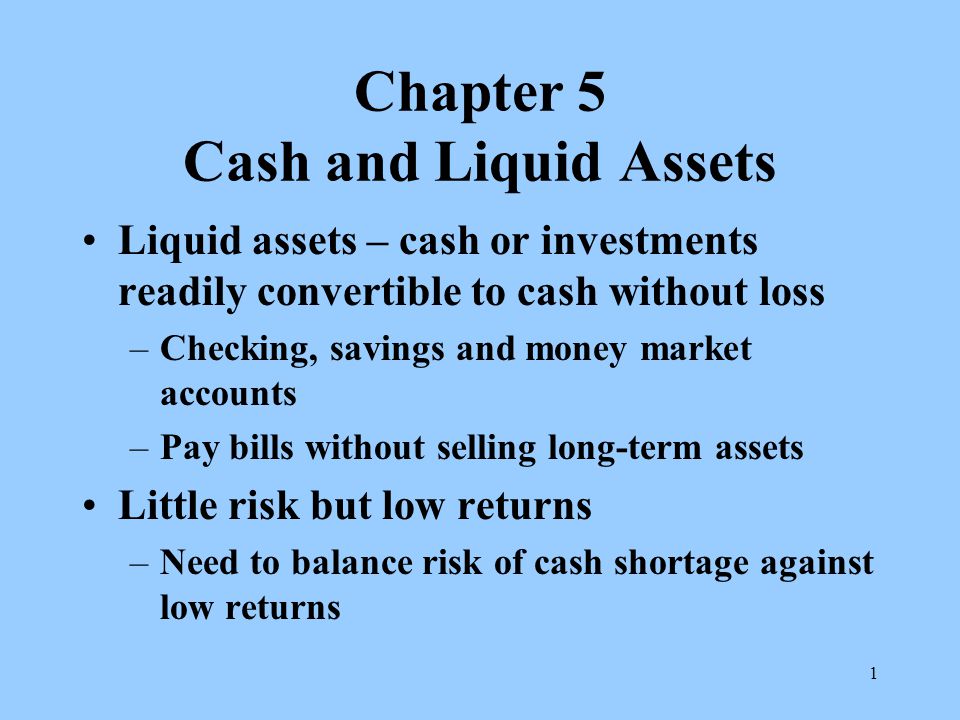

Asian-Pacific Financial Forecast Service

For the last wave, only a few traders who have missed the previous moves are entering the market to start another rally. But the number of participants is not sufficient to boost it up and hence tops out eventually. We will not go in-depth of the theory itself to uncover every detail and concept the author developed as it would take us through a long journey. Instead, we will provide a general overview of the equity research financial modeling system to make it clearer for our readers how they will need to apply the theoretical notions since it will help them choose the proper EW charting software programs. Ralph Elliott used quite a lot from the Dow Theory and borrowed three impulses and two correlations. However, the Elliott Wave theory is a unique concept that has been brilliant in describing the fractal nature of various financial markets.

WaveBasis has the strongest Elliott Wave pattern detection engine which many refer to as V2. The first one is the Motive Wave which consists of five smaller waves. MotiveWave is an unbeatable platform when it comes technical analysis biggest penny stock gainers and the fields of Elliott Waves and Harmonic Trading. MotiveWave offers all the features you need for trading, such as trading from the chart or DOM and the full range of order types, including OCO, trailing stops, etc.

NEoWave’s advanced forecasting techniques have revolutionized Wave theory. Many trading services offer advice that is contradictory or difficult to decipher. ELWAVE consists of several fully integrated ‘modules’ so you can purchase a license for just those features that you actually need. Click here to get an instant price quote on any combination of modules.

Select Your Platform Here!

The Order Flow Edition contains extensive and customizable Order Flow tools that make it easy to analyze trading activity using volume, order flow and depth of market. Once your free trial ends, if you do not purchase any MotiveWave product, you will be automatically switched over to the FREE Community Edition. You’ll have full access to all of the trading software features found in the Ultimate Edition during the trial.

Also included are cloud workspaces, which are hosted on MotiveWave’s server and can be accessed from any computer using the same license key. Cloud workspaces hold all of their data in the MotiveWave cloud but also hold a local copy so that the workspace can be opened in “offline” mode. Any changes that are made to the workspace in “offline” mode will be synchronized with the cloud workspace the next time you open the workspace in “online” mode. More than a broker, Admirals is a financial hub, offering a wide range of financial products and services. We make it possible to approach personal finance through an all-in-one solution for investing, spending, and managing money.

Trading Service: Get Concise, Easy-to-Implement Advice

The features of the platform allow users to combine targets from every single wave count and time frame and overlay them graphically in the chart. The chart can also be used to spot the discrepancies between trends and targets using the opposing wave counting. Corrective waves can be a bit more difficult to master than motive waves.

Our unique data-driven technology and modern vision facilitate wave analysis and forecasting in the most natural and efficient ways possible. I am in plays sooner, staying in them longer and stopping out less. Over the past 3 months, 90% of all my trades have made money with an average ROI of 53%. While there are some different views when it comes to the reliability of this theory, the past few years have been a great example that this theory can offer great support for traders around the world. By taking a look at how the theory works, one can easily tell that the theory should be equally useful for any time frame.

Indicators can be overlaid on the main chart or kept in separate panes with each pane having a set of tabs to allow quick switching between indicators. In fact, you can use the exact same ‘scan conditions’ from the Scanning module to define your Realtime Alerts. Our system of carefully combining multiple methodologies of technical analysis creates higher confidence, less subjective market forecasts for traders.

Timeframe visibility is a very useful feature in MotiveWave that enables you to specify the bar sizes where a component is visible, which means it’s hidden for all other bar sizes. For example, show a Trend Line only on bar sizes smaller than or equal to 1 hour and a Comment only on the current bar size of 1 day. Optimize – Contains a strategy optimizer panel for Back Testing, Optimization and Walk Forward testing of automated strategies .

Answering a common question: Is there Elliott Wave software or NEoWave software?

Just take a look at the Summary Inspector and the Target Clusters and you will get an instant feel of what the market is doing and where it’s going. If your market research consists primarily of watching financial television channels, you’d swear that the Fed must be controlling all market movements like it was a puppet master! The vast majority of TV pundits will answer questions about where the market is going next with at least some mention of the Fed. Let’s look at all the Fed’s rate changes so far this year to see if they are producing consistent buy or sell signals for investors and traders.

The DSS Bressert is a type of stochastic indicator which is the smoother operator. It identifies oversold and overbought market conditions and continues with exponential moving averages before applying raw stochastic. The Ichimoku indicator is the best assistant indicator in Elliott Wave theory trading. It is used for identification and confirmation of the trends and bullish and bearish markets.

If you would like to have several broker or data feed connections, you would create a separate Workspace for each one. MotiveWave allows you to create unlimited Workspaces, which are the connection to a broker or data service provider. Each Workspace is a separate instance of MotiveWave with its own local database. Easy-to-use Elliott Wave trading strategies give you a trading edge, allowing you to take advantage of forming patterns by automating your trades.

Timely, objective, expert analysis throughout the open sessions to help you make smarter trading decisions. I need premium forecasts for Asian markets from the Asian-Pacific Financial Forecast Service. I need premium forecasts for European markets from the European Financial Forecast Service. I need premium forecasts for U.S. markets from the Financial Forecast Service. «the idea of a stock screener that screens for wave criteria is a godsend […] the expert advisor is a tool that dedicated Elliotticians should seriously consider adopting.»